Today both the Shiller PE and the q show the market well above long-term averages. The Shiller PE is about 25 and the q is 0.96. This suggests that investors should be exercising a sharp degree of caution. The corollary of this idea is that these things can take years to play out. The market can go up a long way before it comes back down—if it does.

Friday, November 29, 2013

You really can time the stock market A few key statistics can help average-Joe investors buy low, sell high

Bull Markets Everywhere...

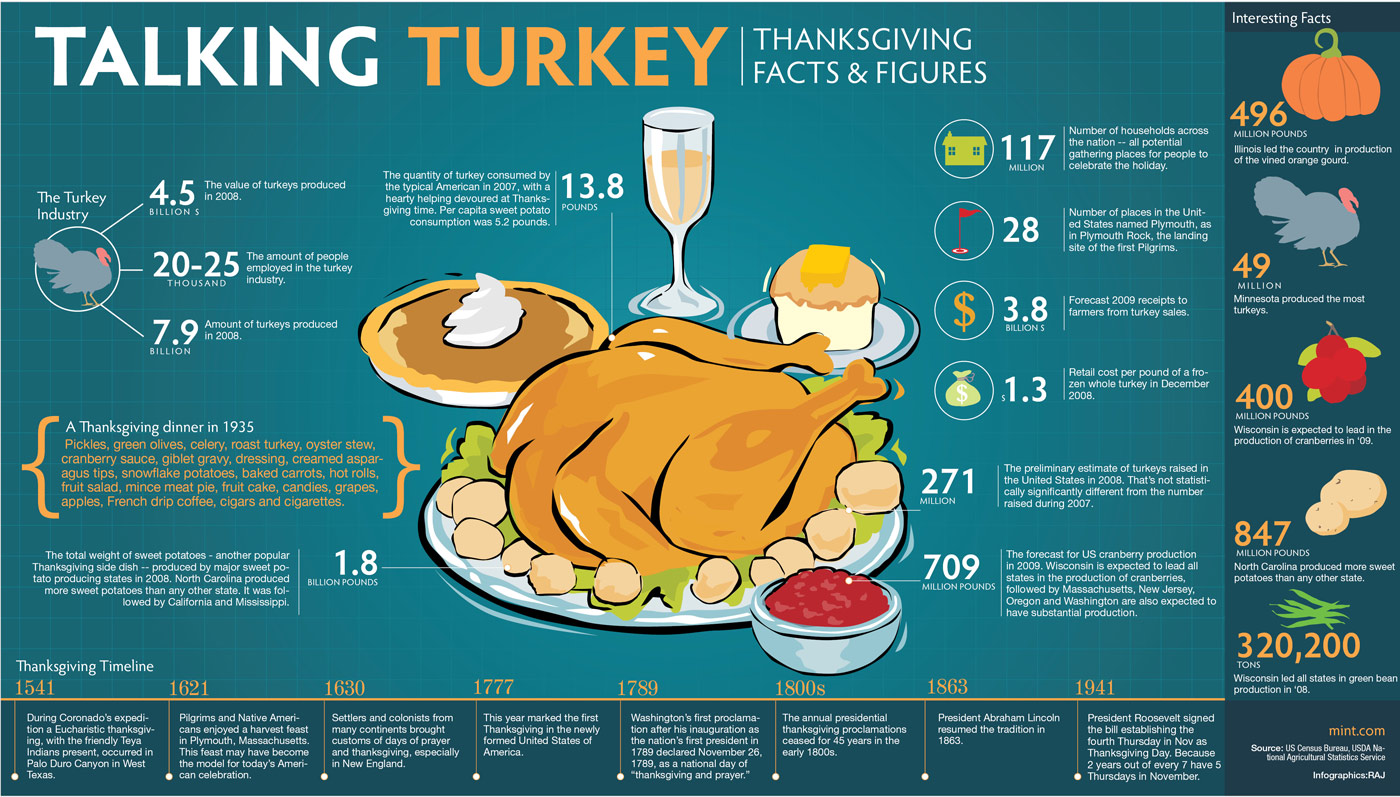

Thursday, November 28, 2013

Talking Turkey

- With U.S. markets closed, consider these items. Yesterday, the S&P 500 made its 38th new high for the year (the record in any one year was 1995 with 77). Year to date breadth remains very positive at 449 issues higher (the record was 458 in 2003). The best performing S&P stock so far this month (that won’t be an S&P stock next week) is JC Penney, +34.4 percent.

- Overnight, without the Americans directing the action, most markets moved higher with the Nikkei up more than 1 percent. The Japanese index has tacked on almost 1300 points since the beginning of the month (compared with a bit more than 500 points on the Dow).

- Other items of news include the first IPO in five years out of Portugal, German unemployment ticks higher for four months in a row (but the unemployment rate unchanged); Microsoft, according to reports, is leaning toward Ford’s Mulally to be the company’s new CEO; Saputo’s A$9.20 bid has been topped by the dairy co-operative by 30 Australian cents; and a deal in media this morning with DHX Media buying Family as well as Disney XD, Disney Junior (French and English) from Bell Media (the parent of BNN) for $170 million cash. We’ll be talking to the CEO of the company about 10:15 am ET this morning. DHX shares are up 140 percent this year alone. DHX recently purchased the rights to Teletubbies (you remember Dipsy, Laa-Laa, Po and Tinky Winky) and is also well known by little ones for Caillou.

- In Moscow’s Red Square an iconic image of luxury and wealth was constructed to house a travelling exhibition of Louis Vuitton’s history. The giant 9 metre by 30 metre building is covered with the gold-on-brown pattern familiar to Baryshnikov, Annie Leibovitz, Catherine Deneuve and Sean Connery (among others) but not necessarily ever used by the ordinary Russian who Vladamir Putin has recently been courting. This box was constructed right next door to Lenin’s tomb. The Russians weren’t impressed. Apparently the charity which was to receive the proceeds from the travelling show is run by the Russian fiancé of the son of the CEO of LVMH. It is being taken down as Mr. Putin wasn’t pleased. I wonder what happened to the bureaucrat who gave the approval for the construction.

Tuesday, November 26, 2013

Double Your Money With The Rule Of 72

Monday, November 25, 2013

S+P seventh week in a row of gains

The chase by Frances Horodelski:

The history of weekly runs of positive gains on the S&P 500 isn’t particularly long. Last week, the index completed its seventh week in a row of gains. The last time the index accomplished this feat was early in 2013.

Prior to that, the last time was in 2011, but before that May 2007. As for streaks of eight weeks, Avondale Asset Management’s homework shows that there have only been eight (nice symmetry there) times that has occurred.

The last time this occurred was January 2004 (according to S&P Capital IQ). Longer streaks have been short – six times for 9 weeks, and one each for 10, 12 and 13 weeks (all data back to 1950). So we may be living on borrowed time but, while consecutive weekly streaks do end, they are usually followed more by a pause than a collapse and a series of further runs continue.

For reference, Friday marked the 37th new high this year for the S&P 500.

www.bnn.ca

Tuesday, November 12, 2013

This summary is not available. Please click here to view the post.