UPDATE 2-Bankers Petroleum reserves growth lags view; shrs sink 12:53 EST Wednesday, March 09, 2011 * Says proved reserves up 30 pct at end 2010 * Proved plus probable reserves up 11 pct to 238 mln barrels

* Shrs fall 10 pct (Rewrites, adds analysts comments in 2nd, 5th, 8th and 10th paragraphs, updates share paragraph)

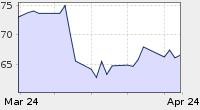

March 9 (Reuters) - Bankers Petroleum Ltd's proved plus probable reserves at its Albanian heavy oil operations rose 11 percent at end 2010, but fell short of market expectations, sending the oil and gas explorer's shares down 10 percent.

"The increase in proven plus probable reserves is toward the bottom end of our expectations for 10-20 percent...the market may have been expecting something closer to the top end," TD Newcrest analyst Jamie Somerville wrote in a note to clients.

The Calgary, Alberta-based company, which posted 2010 production of about 3.5 million barrels, said future undiscounted capital costs for Patos-Marinza and Kucova oil-fields in Albania are estimated at $1.2 billion on proved plus probable reserves basis.

The company, which plans to reactivate 624 wells starting 2011, also said exploration and development costs are estimated at $5.80 per barrel on proved plus probable reserves basis.

The total size of the field (Albanian) is now much higher, so it looks like it is going to cost them (Bankers Petroleum) more on a unit basis to develop the reserves, analyst John of Ticonderoga Securities told Reuters.

The company said proved plus probable reserves were 238 million barrels at Dec. 31, 2010, while proved reserves rose 30 percent to 120 million barrels of oil.

The growth in reserves is attributable to the expansion of horizontal drilling at Patos-Marinza, Bankers Petroleum said in a statement.

"The proved (reserves) outperformed but the probable is down a bit," John Malone said.

In January, the company had reported a 50 percent rise in fourth-quarter oil production. [ID: nSGE70A09R]

"The market is likely to look past any minor disappointment regarding proved plus probable reserves to longer term resource potential, which has increased substantially...," analyst Somerville said.

Bankers Petroleum shares were trading down 87 Canadian cents at C$8.52 on Wednesday on the Toronto Stock Exchange. They touched a low of C8.44 earlier in the session.

Globe says Nuttall expects Bankers to be sold next year

* Proved plus probable reserves up 11 pct to 238 mln barrels

* Shrs fall 10 pct (Rewrites, adds analysts comments in 2nd, 5th, 8th and 10th paragraphs, updates share paragraph)

March 9 (Reuters) - Bankers Petroleum Ltd's proved plus probable reserves at its Albanian heavy oil operations rose 11 percent at end 2010, but fell short of market expectations, sending the oil and gas explorer's shares down 10 percent.

"The increase in proven plus probable reserves is toward the bottom end of our expectations for 10-20 percent...the market may have been expecting something closer to the top end," TD Newcrest analyst Jamie Somerville wrote in a note to clients.

The Calgary, Alberta-based company, which posted 2010 production of about 3.5 million barrels, said future undiscounted capital costs for Patos-Marinza and Kucova oil-fields in Albania are estimated at $1.2 billion on proved plus probable reserves basis.

The company, which plans to reactivate 624 wells starting 2011, also said exploration and development costs are estimated at $5.80 per barrel on proved plus probable reserves basis.

The total size of the field (Albanian) is now much higher, so it looks like it is going to cost them (Bankers Petroleum) more on a unit basis to develop the reserves, analyst John of Ticonderoga Securities told Reuters.

The company said proved plus probable reserves were 238 million barrels at Dec. 31, 2010, while proved reserves rose 30 percent to 120 million barrels of oil.

The growth in reserves is attributable to the expansion of horizontal drilling at Patos-Marinza, Bankers Petroleum said in a statement.

"The proved (reserves) outperformed but the probable is down a bit," John Malone said.

In January, the company had reported a 50 percent rise in fourth-quarter oil production. [ID: nSGE70A09R]

"The market is likely to look past any minor disappointment regarding proved plus probable reserves to longer term resource potential, which has increased substantially...," analyst Somerville said.

Bankers Petroleum shares were trading down 87 Canadian cents at C$8.52 on Wednesday on the Toronto Stock Exchange. They touched a low of C8.44 earlier in the session.

2011-02-10 08:47 ET - In the News

The Globe and Mail reports in its Thursday, Feb. 10, edition that Sprott Asset Management portfolio manager Eric Nuttall believes Bankers Petroleum is ready to soar in tandem with the price of oil. Clea Simos writes in The Globe's BNN Market Call column that Mr. Nuttall says: "Bankers is a low-risk heavy oil development story that has tremendous leverage to a stronger oil price. ... If the price of oil continues to be strong, we expect Bankers to sell themselves in March, 2012, for over $14 a share." The stock finished Wednesday in Toronto at $8.70, down 27 cents. David Whetham of Scotia Asset Management said in The Globe on April 21, 2010, that Bankers Petroleum still had "good growth potential with little risk." It could then be had for $8.71. Mr. Nuttall recommended buying Banker Petroleum in The Globe on June 15, 2010. In the item Mr. Nuttall said Bankers Petroleum will likely be sold over the next two years and fetch about $12 a share. The shares were then worth $7.33. Mr. Nuttall's top holdings in the Sprott Energy Fund are WestFire Energy at 7.5 per cent, Novus Energy at 5.3 per cent, Bankers Petroleum at 4.9 per cent, Painted Pony Petroleum at 4.8 per cent and Vero Energy at 4.7 per cent.

|

| ||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||

The Calgary, Alberta-based company, which posted 2010 production of about 3.5 million barrels, said future undiscounted capital costs for Patos-Marinza and Kucova oil-fields are estimated at $1 billion on a proven reserves basis.

Proved reserves were 120 million barrels of oil at Dec. 31, 2010, while proved plus probable reserves rose 11 percent to 238 million barrels.

In January, Bankers Petroleum had reported a 50 percent rise in fourth-quarter oil production. [ID: nSGE70A09R]

Bankers Petroleum shares closed at C$9.39 on Tuesday on the Toronto Stock Exchange. (Reporting by Arnika Thakur in Bangalore; Editing by Sriraj Kalluvila) (arnika.thakur@thomsonreuters.com within U.S. +1 646 223 8780; outside U.S. +91 80 4135 5800; Reuters Messaging: arnika.thakur.thomsonreuters.com@reuters.net)

| House Positions for C:BNK from 20110309 to 20110309 |

| House | Bought | $Val | Ave | Sold | $Val | Ave | Net | $Net |

| 2 RBC | 312,339 | 2,721,859 | 8.714 | 73,950 | 651,631 | 8.812 | 238,389 | -2,070,228 |

| 7 TD Sec | 595,397 | 5,219,828 | 8.767 | 372,516 | 3,261,718 | 8.756 | 222,881 | -1,958,110 |

| 14 ITG | 233,500 | 2,081,419 | 8.914 | 27,000 | 238,950 | 8.85 | 206,500 | -1,842,469 |

| 89 Raymond James | 463,000 | 4,075,108 | 8.802 | 329,900 | 2,908,997 | 8.818 | 133,100 | -1,166,111 |

| 99 Jitney | 178,300 | 1,558,504 | 8.741 | 130,900 | 1,145,126 | 8.748 | 47,400 | -413,378 |

| 52 NCP | 118,628 | 1,035,289 | 8.727 | 77,083 | 675,464 | 8.763 | 41,545 | -359,825 |

| 123 Citigroup | 39,042 | 357,714 | 9.162 | 0 | 39,042 | -357,714 | ||

| 11 MacQuarie | 258,300 | 2,284,189 | 8.843 | 230,800 | 2,039,793 | 8.838 | 27,500 | -244,396 |

| 90 Barclays | 24,300 | 208,858 | 8.595 | 0 | 24,300 | -208,858 | ||

| 9 BMO Nesbitt | 84,425 | 739,938 | 8.764 | 66,000 | 572,430 | 8.673 | 18,425 | -167,508 |

| 12 Wellington | 39,100 | 345,104 | 8.826 | 25,000 | 223,250 | 8.93 | 14,100 | -121,854 |

| 19 Desjardins | 22,400 | 195,942 | 8.747 | 9,500 | 83,432 | 8.782 | 12,900 | -112,510 |

| 101 Newedge | 11,000 | 97,090 | 8.826 | 0 | 11,000 | -97,090 | ||

| 74 GMP | 9,000 | 79,020 | 8.78 | 0 | 9,000 | -79,020 | ||

| 15 UBS | 12,900 | 111,905 | 8.675 | 5,300 | 46,666 | 8.805 | 7,600 | -65,239 |

| 124 Questrade | 9,105 | 79,205 | 8.699 | 1,700 | 14,928 | 8.781 | 7,405 | -64,277 |

| 72 Credit Suisse | 4,801 | 43,158 | 8.989 | 500 | 4,346 | 8.692 | 4,301 | -38,812 |

| 58 Qtrade | 8,400 | 72,627 | 8.646 | 4,200 | 36,960 | 8.80 | 4,200 | -35,667 |

| 81 HSBC | 5,030 | 43,923 | 8.732 | 1,000 | 8,500 | 8.50 | 4,030 | -35,423 |

| 86 Pictet | 4,000 | 37,200 | 9.30 | 0 | 4,000 | -37,200 | ||

| 65 Goldman | 8,000 | 72,281 | 9.035 | 5,600 | 49,279 | 8.80 | 2,400 | -23,002 |

| 57 Interactive | 2,357 | 21,114 | 8.958 | 0 | 2,357 | -21,114 | ||

| 68 Leede | 2,000 | 17,100 | 8.55 | 0 | 2,000 | -17,100 | ||

| 62 Haywood | 1,800 | 15,840 | 8.80 | 0 | 1,800 | -15,840 | ||

| 46 Macquarie | 1,500 | 12,880 | 8.587 | 0 | 1,500 | -12,880 | ||

| 28 BBS | 500 | 4,315 | 8.63 | 0 | 500 | -4,315 | ||

| 94 Hampton | 80 | 692 | 8.65 | 0 | 80 | -692 | ||

| 22 Fidelity | 0 | 700 | 6,181 | 8.83 | -700 | 6,181 | ||

| 21 Brockhouse | 0 | 900 | 8,380 | 9.311 | -900 | 8,380 | ||

| 54 Global | 0 | 1,000 | 8,810 | 8.81 | -1,000 | 8,810 | ||

| 80 National Bank | 58,569 | 512,070 | 8.743 | 64,109 | 561,640 | 8.761 | -5,540 | 49,570 |

| 85 Scotia | 81,150 | 709,746 | 8.746 | 88,760 | 777,561 | 8.76 | -7,610 | 67,815 |

| 82 Stifel Nicholas | 79,500 | 690,855 | 8.69 | 94,100 | 816,287 | 8.675 | -14,600 | 125,432 |

| 37 MacDougall | 0 | 25,000 | 220,000 | 8.80 | -25,000 | 220,000 | ||

| 39 Merrill Lynch | 14,700 | 126,752 | 8.623 | 68,800 | 611,759 | 8.892 | -54,100 | 485,007 |

| 10 FirstEnergy | 279,800 | 2,499,817 | 8.934 | 340,020 | 3,024,951 | 8.896 | -60,220 | 525,134 |

| 13 Instinet | 3,650 | 32,092 | 8.792 | 64,000 | 581,149 | 9.08 | -60,350 | 549,057 |

| 79 CIBC | 235,535 | 2,066,330 | 8.773 | 315,675 | 2,758,094 | 8.737 | -80,140 | 691,764 |

| 53 Morgan Stanley | 33,172 | 291,136 | 8.777 | 118,493 | 1,058,736 | 8.935 | -85,321 | 767,600 |

| 33 Canaccord | 41,681 | 360,990 | 8.661 | 148,255 | 1,284,786 | 8.666 | -106,574 | 923,796 |

| 77 Peters | 165,900 | 1,467,105 | 8.843 | 394,800 | 3,501,212 | 8.868 | -228,900 | 2,034,107 |

| 1 Anonymous | 179,100 | 1,570,329 | 8.768 | 536,400 | 4,678,308 | 8.722 | -357,300 | 3,107,979 |

| TOTAL | 3,621,961 | 31,859,324 | 8.796 | 3,621,961 | 31,859,324 | 8.796 | 0 | 0 |

And This Indepth News:

2011-03-09 08:21 ET - News Release

Mr. Abby Badwi reports

BANKERS PETROLEUM ANNOUNCES 2010 RESERVES REPORT

Bankers Petroleum Ltd. has released the results of its Dec. 31, 2010, independent reserves evaluation and reports the sixth consecutive year of reserves additions since company inception in 2004.

Evaluations were conducted by RPS Energy Canada Ltd. for the Patos-Marinza oil field, Albania, and by DeGolyer and McNaughton Canada Ltd. for the Kucova oil field, Albania, and were prepared in accordance with National Instrument 51-101 -- "Standards of Disclosure for Oil and Gas Activities."

Total Albania reserves summary

- Proved reserves of 120 million barrels (30-per-cent increase from Dec. 31, 2009) representing over 11 times production replacement;

- Proved plus probable reserves of 238 million barrels (11-per-cent increase from Dec. 31, 2009);

- Proved, probable and possible reserves of 427 million barrels (1-per-cent increase from Dec. 31, 2009);

- Mean original oil in place resource estimate (OOIP) of 7.8 billion barrels (30-per-cent increase from Dec. 31, 2009);

- 2010 production was approximately 3.5 million barrels.

Patos-Marinza field

- Proven reserves increased 30 per cent to 117 million barrels of oil from 90 million barrels at Dec. 31, 2009;

- Proven plus probable reserves increased 11 per cent to 226 million barrels (Dec. 31, 2009 -- 203 million barrels);

- Proved, probable and possible reserves increased 1 per cent to 395 million barrels (Dec. 31, 2009 -- 390 million barrels);

- Original oil in place estimate (P50) increased 32 per cent to 7.5 billion barrels (Dec. 31, 2009 -- 5.7 billion barrels)

- All of Patos-Marinza's 2010 recoverable reserves estimates are from primary recovery methods only.

The 2010 reserves growth is primarily attributable to the expansion of the company's horizontal drilling program in new areas of the field and new zones within the field area. This is reflected in the upgrade of proven and probable, and proved, probable and possible reserves into the proven and proven plus probable reserves categories, respectively, and the expansion of proved, probable and possible reserves and oil in place.

Patos-Marinza contingent and prospective resources

RPS has also released an update with respect to the contingent and prospective resource oil estimates for the Patos-Marinza oil field as at Dec. 31, 2010. Contingent and prospective resources are based on thermal development technologies to be applied to the Gorani and Driza formations and secondary waterflood methods proposed for the Marinza formation and expansion of the development areas, primarily to the west of the current development.

The thermal pilot first steam injection is scheduled for the third quarter of 2011. There are no current waterflood plans for the field.

Contingent resource for 2010 is 1.2 billion barrels, compared with 838 million barrels in 2009;

Prospective resource for 2010 is 568 million barrels, compared with 384 million barrels in 2009.

Kucova field

There were no activities or company production from the field in 2010; field reserves remain unchanged. Early stage development has begun with road building and lease clearing.

- 1P reserves 3 million barrels;

- 2P reserves 11 million barrels;

- 3P reserves 32 million barrels;

- Mean original oil in place resource estimate remains unchanged at 297 million barrels.

Total Net Present Value of Total Albania Reserves (After Tax, discounted at 10%)

- 1P reserves US$949 million - 2P reserves US$1.97 billion - 3P reserves US$3.55 billion - Values are based on RPS (Patos-Marinza) and D&M (Kuçova) January 1, 2011 price forecast tables summarized below - Basic shares outstanding of as of December 31, 2010 were approximately 245 million

Finding and Development Costs ("F&D")

With successful results from the Company's horizontal drilling activities in the northern part of Patos-Marinza oilfield, the Company is expanding the horizontal drilling program into the central, southern and western part of the field. Also, due to casing failures in old vertical wells, replacement of old vertical wells with new horizontal wells has been added to the capital program. Accordingly, in the 2P development case, the number of well re-activations has been reduced to 310 wells and new horizontal wells have increased from 260 wells in the previous year's projected capital program to 624 wells in 2011 and beyond.

Future undiscounted capital costs for Patos-Marinza and Kuçova are now projected to be US$1.5 billion, US$1.2 billion and US$1.0 billion on a 3P, 2P and 1P basis, respectively. This represents the following F&D costs:

- 1P reserves US$10.06 per barrel - 2P reserves US$5.80 per barrel - 3P reserves US$3.85 per barrel

Gross Oil Reserves - Using Forecast Prices (MMbbls)

-------------------------- ----------------- 2010 2009 -------------------------- Patos- Total Total Marinza Kuçova Albania Albania % ------------------------------------------------------- ----------------- Proved Developed Producing 17.3 - 17.3 22.9 -24 Developed Non-Producing - - - - - Undeveloped 99.7 3.2 102.9 69.9 47 -------------------------- ----------------- Total Proved 117.0 3.2 120.2 92.8 30 Probable 109.2 8.2 117.4 121.1 -3 -------------------------- ----------------- Total Proved Plus Probable 226.2 11.4 237.6 213.9 11 Possible 168.4 20.6 189.0 208.4 -9 -------------------------- ----------------- Total Proved, Probable & Possible 394.6 32.0 426.6 422.3 1 ------------------------------------------------------- -----------------

Net Present Value at 10% - After Tax Using Forecast Prices ($ millions)

-------------------------- ----------------- 2010 2009 -------------------------- Patos- Total Total Marinza Kuçova Albania Albania % ------------------------------------------------------- ----------------- Proved Developed Producing 220 - 220 149 48 Developed Non-Producing - - - - - Undeveloped 710 19 729 377 93 -------------------------- ----------------- Total Proved 930 19 949 526 80 Probable 904 115 1,019 993 3 -------------------------- ----------------- Total Proved Plus Probable 1,834 134 1,968 1,519 30 Possible 1,278 306 1,584 1,514 5 -------------------------- ----------------- Total Proved, Probable & Possible 3,112 440 3,552 3,033 17 ------------------------------------------------------- -----------------

Patos-Marinza Contingent and Prospective Resource (MMbbls)

---------------------- 2010 2009 % --------------------------------------------------------- Contingent Resource 1,200 838 43 --------------------------------------------------------- Prospective Resource 568 384 48 --------------------------------------------------------- Total Resources 1,768 1,222 45 ---------------------------------------------------------

Reserve Auditor Price Decks - Dated Brent

--------------------------------------- BRENT Oil Price Forecast US$/bbl --------------------------------------- Year RPS D&M --------------------------------------- 2011 $90.00 $91.00 --------------------------------------- 2012 $89.50 $91.78 --------------------------------------- 2013 $89.10 $92.64 --------------------------------------- 2014 $89.25 $94.57 --------------------------------------- 2015 $91.00 $97.58 --------------------------------------- 2016 $93.20 $99.58 --------------------------------------- 2017 $95.30 $101.61 --------------------------------------- 2018 $97.30 $103.68 --------------------------------------- 2019 $99.40 $105.79 --------------------------------------- 2020 $101.58 $107.95 --------------------------------------- 2021 $103.61 $110.15 --------------------------------------- 2022 $105.68 $112.39 --------------------------------------- 2023 $107.80 +2.0% Thereafter ---------------------------------------

Field gate prices the Company is receiving in Albania are currently at a discount to Brent:

-- Patos-Marinza field gate price is approximately 65% of Brent; -- Kuçova field gate price is approximately 70% of Brent

For additional information, please see an updated version of the Company's corporate presentation on www.bankerspetroleum.com

Conference Call

The Management of Bankers will host a conference call on March 9, 2011 at 7:30am MST to discuss this reserves report. Following Management's presentation, there will be a question and answer session for analysts and investors.

To participate in the conference call, please contact the conference operator ten minutes prior to the call at 1-888-231-8191 or 1-647-427-7450. A live audio web cast of the conference call will also be available on Bankers website at www.bankerspetroleum.com or by entering the following URL into your web browser http://www.newswire.ca/en/webcast/viewEvent.cgi?eventID=3434640

The web cast will be archived two hours after the presentation on the website, and posted on the website for 90 days. A replay of the call will be available until March 23, 2011 by dialing 1-800-642-1687 or 1-416-849-0833 and entering access code 50341069.

Review by Qualified Person

This release was reviewed by Abdel F. (Abby) Badwi, CEO of Bankers Petroleum Ltd., who is a "qualified person" under the rules and policies of AIM in his role with the Company and due to his training as a professional petroleum geologist (member of APEGGA) with over 40 years experience in domestic and international oil and gas operations.

We seek Safe Harbor.

0.58 0.55%

0.58 0.55%