From The Motley Fool

What happened

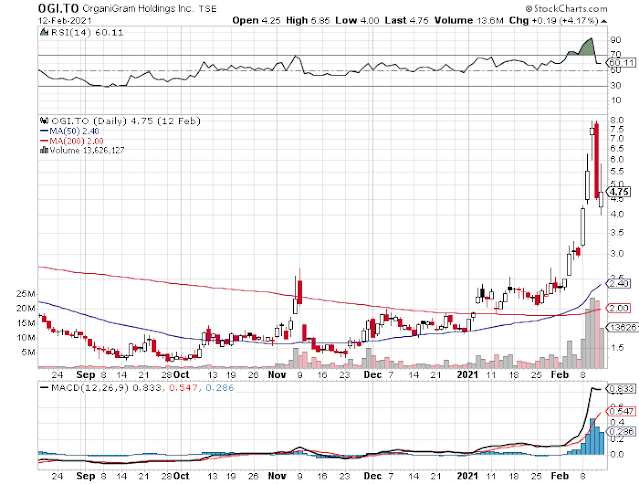

On a day when some marijuana stocks shot to the moon, shares of OrganiGram Holdings (NASDAQ:OGI) rose modestly. While peer stocks closed Tuesday higher in the double-digit percentages, OrganiGram "only" increased by 7% and change.

So what

Like its fellow pot purveyors, OrganiGram stands to benefit from an apparently accelerated timetable for Congress to introduce and enact marijuana reform legislation.

While some of its peers could potentially reach across the border to directly sell tons of product here, OrganiGram is a comparatively small operator based in eastern Canada.

IMAGE SOURCE: GETTY IMAGES.

The company also announced Tuesday that Senior Vice President of Operations Matt Rogers is departing at the end of May.

In addition to being an important manager at OrganiGram, Rogers was one of its first employees. OrganiGram wrote that his "insights and creativity have been instrumental" to its efforts.

Now what

The departure of a valued and clearly experienced executive is less than ideal. This is particularly true in the marijuana sector, where seasoned management remains in short supply (to be fair, the licensed cannabis business is only a few years old).

OrganiGram hasn't named a direct replacement for Rogers, but it did mention that before his departure, he'll work closely with newly appointed Plant Manager Nathalie Batten. Hopefully, he will impart most of his knowledge on his way out the door.

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends OrganiGram Holdings. The Motley Fool has a disclosure policy.

https://www.fool.com/quote/nasdaq/organigram-holdings/ogi/

What happened

Cannabis stocks have been on a wild ride this week starting with chatter among Reddit users that likely caused a surge across the sector. That trend reversed on Thursday, however, and the stocks are bouncing around again today.

Shares of OrganiGram Holdings (NASDAQ:OGI), for example, dropped 14% early Friday morning, before reversing to a 15% gain as of 10:55 a.m. EST. Shares of Aurora Cannabis (NYSE:ACB) and HEXO (NYSE:HEXO) were also each down double digits early in the session, but have settled back to a drop of 7% and a gain of 3%, respectively.

https://www.fool.com/investing/2021/02/12/why-aurora-cannabis-organigram-holdings-and-hexo-d/

From the Reddit Board

OrganiGram Holdings HOLD Lastly, if you want a marijuana stock with real potential, OrganiGram Holdings (NASDAQ:OGI) is where to put your money to work -- not Sundial.

Similar to Sundial Growers, OrganiGram is based in Canada. But unlike its peers, it's the only major grower headquartered in the Atlantic region of our neighbor to the north. Interestingly, even though Canada's Atlantic region provinces are less populated, adult cannabis use rates are much higher in these provinces and territories than the national average.

Aside from having a geographic advantage, OrganiGram's Moncton facility in New Brunswick stands out for a number of reasons. First, since the company only has one production and processing site, it can adjust its supply chain more easily than its peers. It also doesn't hurt that the company employs a three-tiered growing system, which should help reduce long-term per-gram production costs while maximizing yield per licensed room.

OrganiGram should fare well on the margin front, too. It spent an estimated $15 million Canadian on a line of fully automated equipment to make up to 4 million kilos of chocolate edibles each year. The company developed a proprietary beverage powder, as well. These higher-margin consumption options can help offset the lower margins and commoditization potential seen in value-based dried cannabis flower.

Compared to Sundial, OrganiGram is a night-and-day better company, and a much smarter penny stock to buy.

And this post

I’m 40@5.45 will prob add more to average down. This is a longer term play y’all. Will it jump quickly? Yes probably but it will probably be volition and go back down. These weed stocks are long play because we have legislation to look forward to. I sleep better at night knowing that as of right now OGI is pretty sound financially and has good fundamentals as far as I know.

And this post

Motley fool considered it as a potential 10x stock. It won’t do that overnight but I see it happening in time. I would say set your price and wait. I know this past week it surged but remember it is goes up quickly it has a big potential to fall quickly. I feel confident in the purchase.

https://www.reddit.com/r/OGIstock/comments/lj5d7x/where_are_we_at/