GATINEAU, Quebec, Jan. 30, 2019 (GLOBE NEWSWIRE) -- HEXO Corp. (“HEXO” or the “Company”) (TSX: HEXO; NYSE-A: HEXO) is pleased to announce the closing of its previously announced marketed offering of 8,855,000 common shares at a price of C$6.50 per share for aggregate gross proceeds of C$57,557,500, which includes the exercise of the full over-allotment option of 1,155,000 common shares.

The Company will use the net proceeds from the Offering for general corporate purposes, including funding the Company’s global growth initiatives and research and development to further advance the Company’s innovation strategies.

CIBC Capital Markets and BMO Capital Markets are the lead underwriters and joint book-running managers and Oppenheimer & Co. Inc. is the co-lead underwriter for the Offering. The co-managers for the Offering are AltaCorp Capital Inc., Beacon Securities Limited, Bryan, Garnier & Co Ltd, Cormark Securities Inc., Eight Capital, GMP Securities L.P., Laurentian Bank Securities Inc., PI Financial Corp. and Roth Capital Partners, LLC.

The common shares were offered in each of the provinces and territories of Canada by way of a prospectus supplement dated January 24, 2019 to the Company’s amended and restated short form base shelf prospectus dated December 14, 2018 and in the United States pursuant to a registration statement on Form F-10 in accordance with the U.S./Canada Multijurisdictional Disclosure System.

Copies of the prospectus supplement, short form base shelf prospectus and registration statement may be obtained in Canada from CIBC Capital Markets, 22 Front Street West, Mailroom, Toronto, ON, M5J 2W5, by telephone at (416) 956-3636, by email at

michelene.dougherty@cibc.ca or from BMO Capital Markets, Brampton Distribution Centre c/o The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2, by telephone at 905-791-3151 Ext. 4312 / 4322, or by email at

torbramwarehouse@datagroup.ca and in the United States from CIBC Capital Markets, 425 Lexington Avenue, 5th floor, New York, NY, by telephone at (800) 282-0822, by email at

useprospectus@cibc.com or from BMO Capital Markets Corp., Attn: Equity Syndicate Department, 3 Times Square, 25th Floor, New York, NY 10036 (Attn:Equity Syndicate), or by telephone at (800) 414-3627, or by email at

bmoprospectus@bmo.com.

No securities regulatory authority has either approved or disapproved of the contents of this press release. This press release is for information purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About HEXO

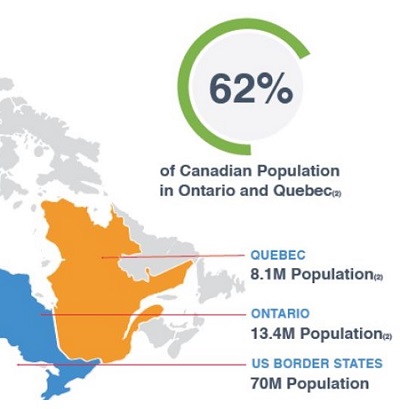

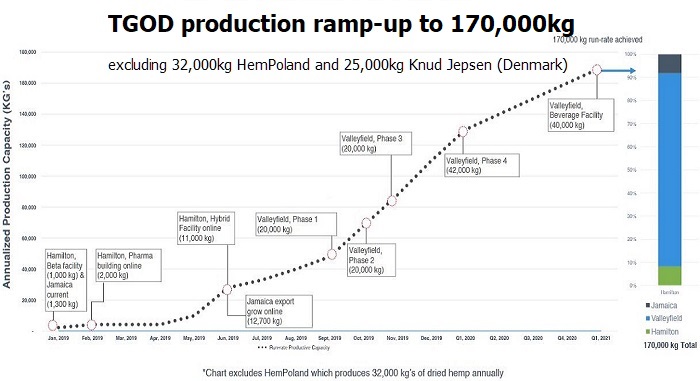

HEXO Corp. is an award-winning consumer-packaged goods cannabis company that creates and distributes award-winning products to serve the global cannabis market. As one of the largest licensed cannabis companies in Canada, HEXO Corp. operates with over 1.3 million sq. ft. of facilities in Ontario and Quebec and a foothold in Greece with plans to establish a Eurozone processing, production and distribution centre. We serve the Canadian adult-use market under the HEXO brand while continuing to provide our medical cannabis clients with consistent access to Hydropothecary medical cannabis products.

Forward-Looking Statements