A Stock Pickers Market MARKET OUTLOOK (From BNN)

A year ago, we warned viewers that various speculative manias such as cannabis stocks, cryptocurrencies and blockchain were signs of a market top. Towards the end of 2018, we finally saw a massive sell-off in equity markets led by the U.S. The American stock market was disconnected from global markets which were already struggling and it was grossly overvalued, mainly led by a small group of tech stocks. Rising interest rates, a strong U.S. dollar and U.S. trade wars started having an impact on U.S. corporations, as 44 per cent of S&P companies derive their revenues from foreign markets that were slowing down.

The pull-back in equity prices was amplified by computer-driven algorithmic program selling, high-frequency trading, momentum strategies, quantitative models, the liquidation of several large hedge funds, and the indiscriminate selling of baskets of stocks held in ETFs triggered by panicky and leveraged retail investors as well as tax loss selling. It’s estimated that 85 per cent of trading volume had nothing to do with actual company fundamentals, a fact borne out by the equally rapid rebound in stock prices being experienced by global equity markets thus far in 2019. The “the herd effect” has only gotten bigger with the growth in automated trading and ETFs, leading to more pronounced periods of over and undervaluation.

This suggests that markets are becoming less efficient, creating better opportunities for active portfolio managers going forward. While valuations have come down to more attractive levels, given the ongoing economic and geopolitical uncertainties, equity markets are likely to remain volatile. We continue to be very selective and generally stick to defensive stocks with low exposure to cyclical or economically sensitive sectors relative to the market.

Wednesday, January 30, 2019

Computer-driven algorithmic program selling, manipulates your favorite MJ Stock daily

Tuesday, January 29, 2019

TGOD 2019 Is Going To Be A Winning Stock!

author

Daniel Schaad - CannabisReport.de

date

01/25/2019

Which stock is the cheapest? When evaluating cannabis stocks,

you can use the following parameters for comparison ...

you can use the following parameters for comparison ...

In general, one can not compare the fundamental valuation in a mega growth market such as the cannabis industry with established blue chip companies from DAX or Dow Jones. Rather, you have to filter the Weed shares among each other in a peer-group comparison with the key figures below and find out the fundamentally cheap and expensive stocks based on these numbers.

I use here at Cannabis Report .de internally a comprehensive rating table, which takes into account not only the ratio of P / fully funded capacity in kg, but also other parameters P / Book Ratio , P / Sales and P / EBITDA . Together, these three metrics make up the so-called "magic number", which allows me to determine in real time whether a cannabis company is fundamentally cheap or relatively cheap relative to its competitors.

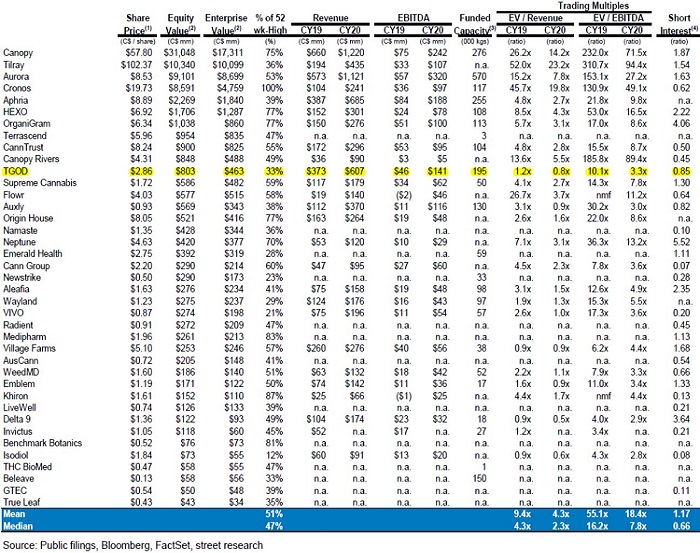

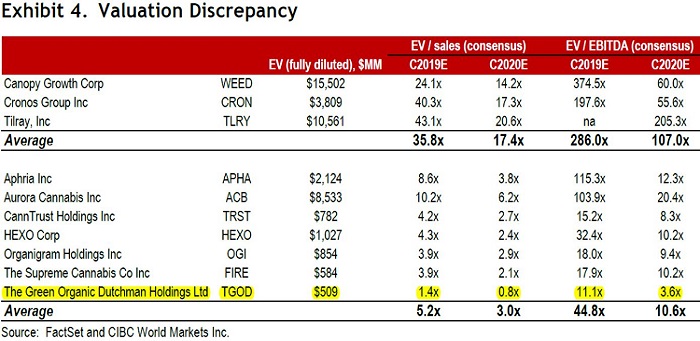

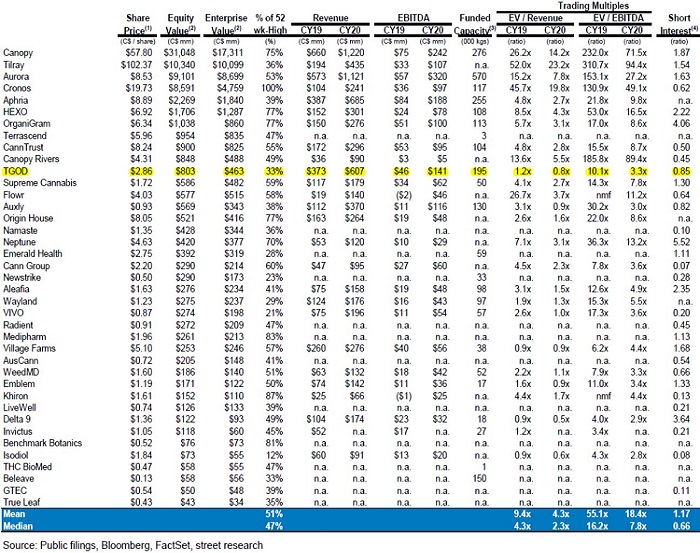

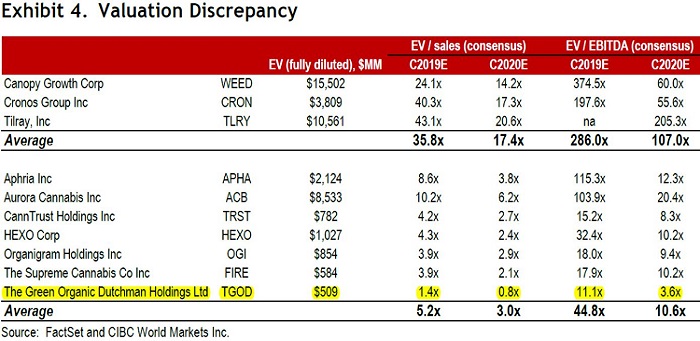

Recently, the two brokerage houses CIBC and BMO Capital Markets published insightful peer-group comparisons listing expected revenues and EBITDA for the years 2019 and 2020, as well as the funded capacity and also EV / Revenue and EV / sales and EV / EBITDA key figures.

My current favorite in the sector The Green Organic Dutchman (TSX: TGOD / WKN: A2JLEE) I have highlighted in yellow in both tables.

Graphic: BMO Capital Markets

Graphic: BMO Capital Markets

Graphic: CIBC

Graphic: CIBC

What is striking?

TGOD will generate the 4 th highest sales and EBITDA among all Canadian LPs (licensed producers), as well as being the largest producer of organic cannabis worldwide. Nevertheless, you are only in eleventh place when it comes to the market cap.

Especially a comparison with Cronos is interesting. TGOD will generate higher sales and higher EBITDA, but is valued at only $ 0.9 billion. Cronos 3.6 billion CAD.

The EV / sales for 2019/20 with 1.4x and 0.8x compared to the peer-group with 5.2x and 3.2x are very favorable.

EV / EBITDA at TGOD for 2019/20 is at 11.1x and 3.6x vs. peer-group at 44.8x and 11.2x respectively.

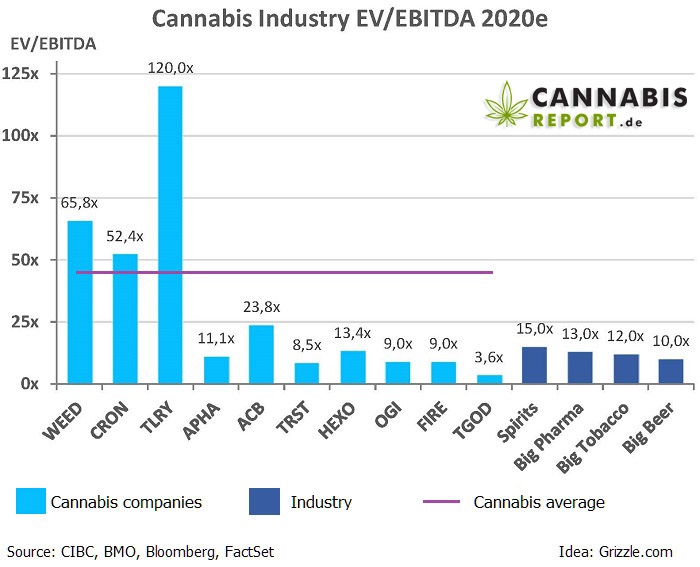

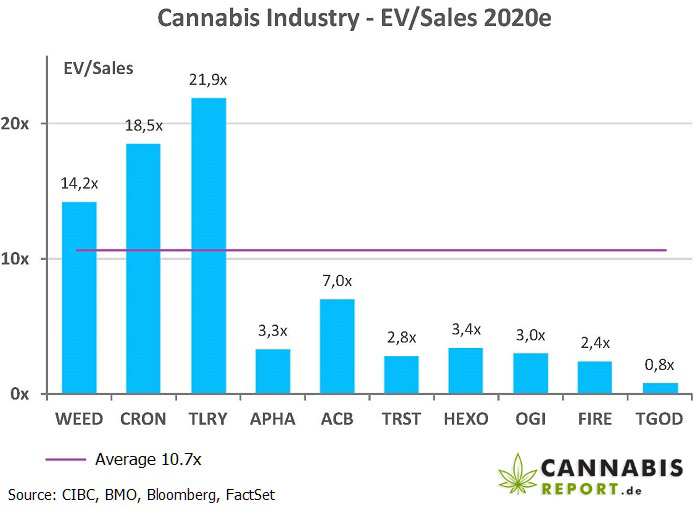

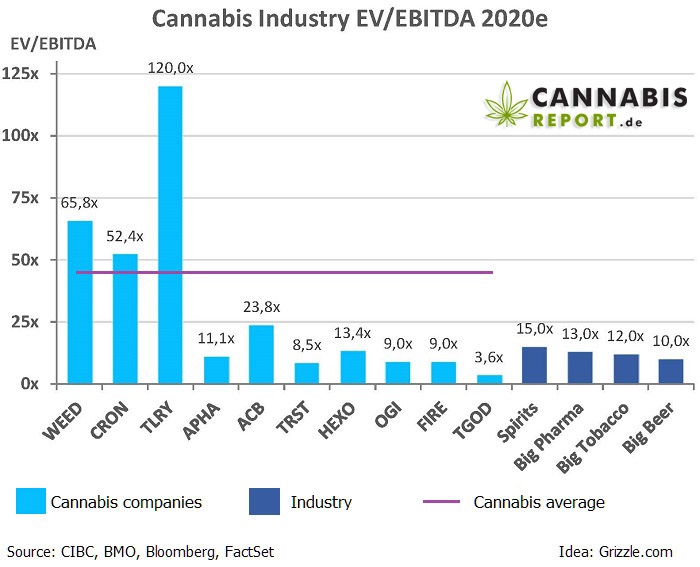

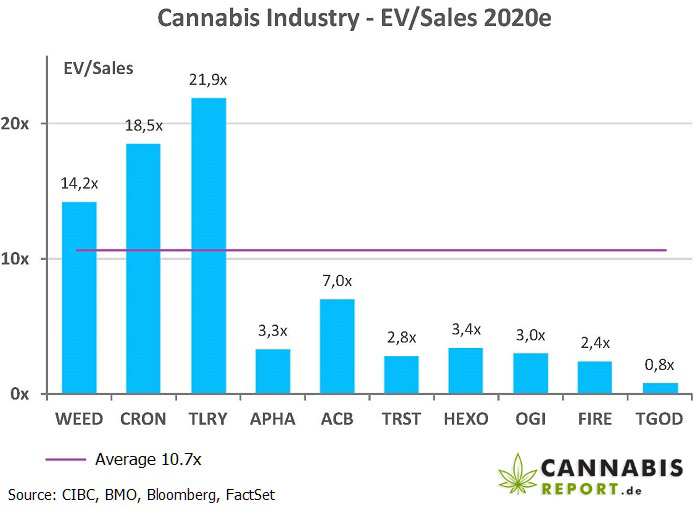

The following two graphics were put together by me from the data of CIBC and BMO. In addition, these estimates were checked for plausibility.

The EV / EBITDA ratio is perhaps the most important KPI that professional investors use when valuing equities.EV stands for enterprise value or equity value and is the market cap - (minus) net cash and + (plus) net debt. This value is then divided by the EBITDA. So profits before taxes, interest and depreciation. The lower this ratio the cheaper the company is rated.

The EV / Sales metric does not take profits into account, just the company's revenues. In German enterprise value divided by turnover. Again, the market cap + debt or - net cash is calculated. This value is divided by the sales and receives the ratio. Again, the lower this value, the cheaper the company is rated.

A lot has happened since our first report on the day of the TGOD IPO.

We bought the stock on May 9, 2018 at $ 3.65 . On September 20, we sold $ 8.65 at 137% and on November 1,we almost doubled our position at $ 2.80 .

The goal is:

and you are on the best way there.

The fully funded capacity of TGOD has now grown to 195,000 kg , and there are about 300 million CAD in liquid funds in the cash. This ranks fourth among all Canadian LPs in terms of production capacity. At the same time you will become the largest producer of organic cannabis worldwide, which achieves an approx. 30% premium to conventional weed.

In addition to Ontario and Quebec in Canada, various joint ventures are now also active in Poland (HemPoland), Jamaica (Epican), Denmark (Knud Jepsen) and Mexico (LLACA Grupo). Currently, there are also rumors from Greece for an entry of TGOD.

Ancaster Facility Update, January 15, 2019 from The Green Organic Dutchman on Vimeo.I use here at Cannabis Report .de internally a comprehensive rating table, which takes into account not only the ratio of P / fully funded capacity in kg, but also other parameters P / Book Ratio , P / Sales and P / EBITDA . Together, these three metrics make up the so-called "magic number", which allows me to determine in real time whether a cannabis company is fundamentally cheap or relatively cheap relative to its competitors.

Recently, the two brokerage houses CIBC and BMO Capital Markets published insightful peer-group comparisons listing expected revenues and EBITDA for the years 2019 and 2020, as well as the funded capacity and also EV / Revenue and EV / sales and EV / EBITDA key figures.

My current favorite in the sector The Green Organic Dutchman (TSX: TGOD / WKN: A2JLEE) I have highlighted in yellow in both tables.

What is striking?

TGOD will generate the 4 th highest sales and EBITDA among all Canadian LPs (licensed producers), as well as being the largest producer of organic cannabis worldwide. Nevertheless, you are only in eleventh place when it comes to the market cap.

Especially a comparison with Cronos is interesting. TGOD will generate higher sales and higher EBITDA, but is valued at only $ 0.9 billion. Cronos 3.6 billion CAD.

The EV / sales for 2019/20 with 1.4x and 0.8x compared to the peer-group with 5.2x and 3.2x are very favorable.

EV / EBITDA at TGOD for 2019/20 is at 11.1x and 3.6x vs. peer-group at 44.8x and 11.2x respectively.

The following two graphics were put together by me from the data of CIBC and BMO. In addition, these estimates were checked for plausibility.

The EV / EBITDA ratio is perhaps the most important KPI that professional investors use when valuing equities.EV stands for enterprise value or equity value and is the market cap - (minus) net cash and + (plus) net debt. This value is then divided by the EBITDA. So profits before taxes, interest and depreciation. The lower this ratio the cheaper the company is rated.

The EV / Sales metric does not take profits into account, just the company's revenues. In German enterprise value divided by turnover. Again, the market cap + debt or - net cash is calculated. This value is divided by the sales and receives the ratio. Again, the lower this value, the cheaper the company is rated.

Update THE GREEN ORGANIC DUTCHMAN (TSX: TGOD / US: TGODF / WKN: A2JLEE)

A lot has happened since our first report on the day of the TGOD IPO.

We bought the stock on May 9, 2018 at $ 3.65 . On September 20, we sold $ 8.65 at 137% and on November 1,we almost doubled our position at $ 2.80 .

The goal is:

"Become the Global Leader in delivering Premium Organic Cannabis Solutions"

and you are on the best way there.

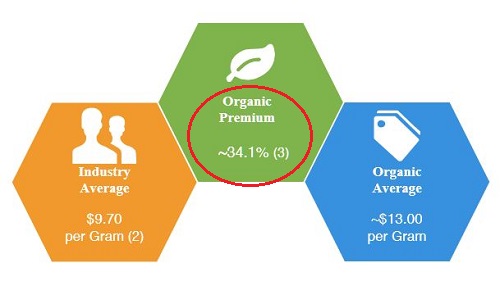

The fully funded capacity of TGOD has now grown to 195,000 kg , and there are about 300 million CAD in liquid funds in the cash. This ranks fourth among all Canadian LPs in terms of production capacity. At the same time you will become the largest producer of organic cannabis worldwide, which achieves an approx. 30% premium to conventional weed.

In addition to Ontario and Quebec in Canada, various joint ventures are now also active in Poland (HemPoland), Jamaica (Epican), Denmark (Knud Jepsen) and Mexico (LLACA Grupo). Currently, there are also rumors from Greece for an entry of TGOD.

rt.de/upload/meine_bilder/blog/TGOD-summary-operations.jpg" style="margin: 0px; width: auto;" />

Sales are currently generated in Jamaica and Poland. The first delivery of medical cannabis in Canada should be in a few days / weeks. Lt. Valleyfield Facility Update, January 23, 2019 from The Green Organic Dutchman on Vimeo.

>Management is progressing according to plan at Valleyfield and Ancaster, and here, too, they will be able to harvest and sell in H1 and H2 2019.

HIGHLIGHTS:

- Fully funded capacity 195,000 kg

- very low EV / EBITDA and EV / Sales

- Organic cannabis achieves a premium over normal cannabis

- With Emily Demeo as Marketing Brand Director, Molson Coors' former "Innovations Strategin" board is on board

- Around 300 million CAD cash

- Largest producer of organic cannabis from 2019/2020

- Construction in Ancaster is going according to plan. Completion expected in Q1 2019, first harvest in H1 2019

- Valleyfield: First cultivation expected in Q2 in 2019. Harvest in H2 2019

- Aurora Cannabis holds 28.8 million shares + 19.8 million warrants from TGOD

- Tim Seymour was called to the board. As the founder and CIO of Seymour Asset Management Co-Founder and CIO of Triogem Asset Management, he can help TGOD expand into the US and also seek a listing on the NYSE

Here are two recent videos on progress in Valleyfield and Ancaster.

Valleyfield, Quebec Facility Update, January 23, 2019

Valleyfield Facility Update, January 23, 2019 from The Green Organic Dutchman on Vimeo.

Ancaster, Ontario Facility Update January 15, 2019

Ancaster Facility Update, January 15, 2019 from The Green Organic Dutchman on Vimeo.

See more videos at this link:

https://vimeo.com/313054897

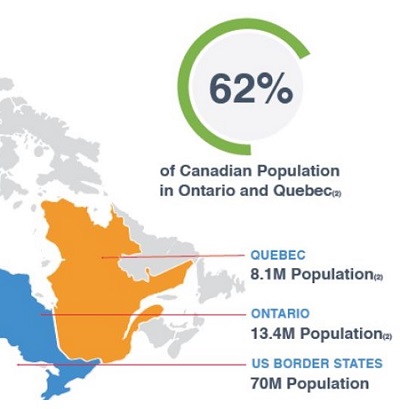

There are 36 million people throughout Canada. Alone 22.3 million or 62% of all Canadians are at home in Ontario and Quebec. So it makes perfect sense to focus on these two locations. It is estimated that a supply bottleneck is expected right here.

International strategy of TGOD

Through partnerships and acquisitions in Jamaica, Denmark, Poland and Mexico , it is expanding its presence worldwide.

TGOD bought 49.18% of Epican Medicinals in Jamaica. First, in July 2018, a store was opened in Kingston, and four more are to be added. Including in February 2019 a store in Montego Bay. Currently the capacity in Jamaica is 1.300kg but should be increased to 14.000kg. It is worth noting that Epican was the first company in Jamaica to be granted a cultivation license. The founders of Epican - the McKenzie brothers - have always been pioneers of medical marijuana in Jamaica.

Here's a picture of the 4,000 sq ft flagship store in Kingston. (Source: Epican / TGOD)

In Denmark, a joint venture was formed with Queen Genetics / Knud Jepsen . In Phase 1 you want to grow 2,500kg cannabis, and then increase to 25,000kg.

In Poland , TGOD took over the producer of CBD oil HemPoland. This one has, among other things, the brand CannabiGold in the offer, which I have already seen in Germany (Berlin) in public sale. HemPoland sells in 13 European countries and has been on the market since 2014. The capacity here is 32,000kg dried hemp per year.

In Mexico , a 50/50 sale and distribution partnership has been signed with Grupo LLC. Nationwide access is available to 4,500 Apothks and 3,100 supermarkets.

Rumors from Greece

Since January 24, there are tangible rumors about the entry of TGOD in Greece . There is talk of a volume of EUR 74 million (CAD 111 million) and 34 acres (hectares) of cultivation in the area around Thebes.

In sum, I could now find four press releases in Greek mentioning TGOD or "TGOD Hellas" . The fact that the Greek Minister for Development and Food (Mr. Kokkalis) officially comments on this information makes the rumor believable. It seems to be true and TGOD is planning a huge production in Greece. 34 acres equals 1,481,040 square feet. This would make the area 20% larger than Valleyfield where 142,000kg of high-quality organic cannabis should be produced. Gigantic!

Among other things, it says in the message:

"This is TGOD Hellas, a subsidiary of the Canadian company TGOD Inc., which is implementing in Greece the largest investment in the production and processing of pharmaceutical cannabis of 74 million.

The crop is expected to start in early 2020 and wants to create hundreds of direct and indirect jobs for the Greek economy. TGOD intends to engage with Greek Universities to fund scientific research, aiming at making Greece a World Innovation Center for cannabinoid-based medicines.

It is noted that the facilities of TGOD in Greece will be referred to the GACP and eGMP standards with the Canadian and International Facilities of the Company and will apply to the same organic farming protocols.

Mr. Kokkalis pointed out that he made his contribution to the development of the sector in Greece and had his full support, as well as the ministry officials. "

The crop is expected to start in early 2020 and wants to create hundreds of direct and indirect jobs for the Greek economy. TGOD intends to engage with Greek Universities to fund scientific research, aiming at making Greece a World Innovation Center for cannabinoid-based medicines.

It is noted that the facilities of TGOD in Greece will be referred to the GACP and eGMP standards with the Canadian and International Facilities of the Company and will apply to the same organic farming protocols.

Mr. Kokkalis pointed out that he made his contribution to the development of the sector in Greece and had his full support, as well as the ministry officials. "

A link to CNN here in the English translation and below the original:

TGOD on CNN

Original link to CNN: TGOD - CNN - Original

It will not be long before TGOD comes out with an official press release to confirm the rumors. I already expect it today.

Go Organic! About 30% premium over conventional marijuana

TGOD is currently one of 146 LPs (licensed producers) in Canada but only one of two focused on the production of organic cannabis.

The peculiarity of the cannabis produced by TGOD is the absence of synthetic fertilizers or other pesticides.Organic cannabis tends to be priced around 30% higher than compared to commonly made cannabis.

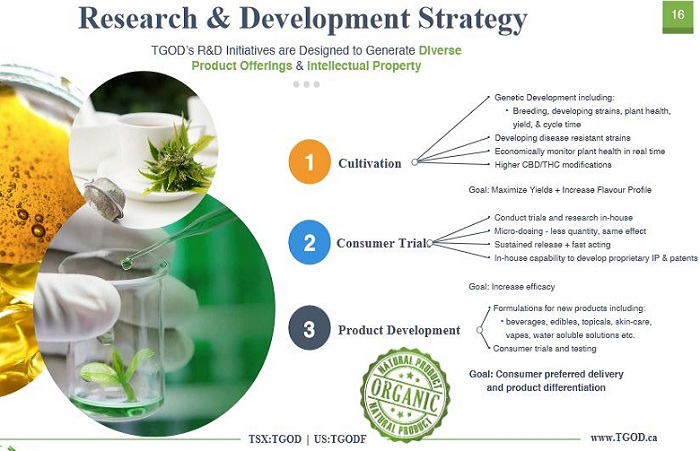

Research and Development: Cannabis Beer?

If you look at the company presentation, it becomes clear - the focus is not only on the production of cannabis and the current capacity of 195,000 kg per year - but expansion, as well as research and development are also very important in TGOD.

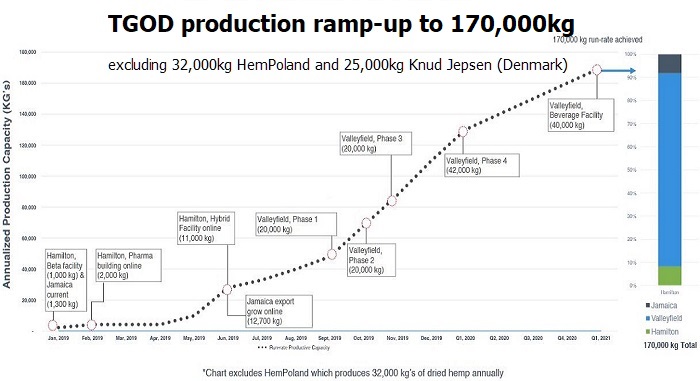

The way to 170.000kg per year

Click on the graphic to enlarge. Not included are Hemopoland's 32,000 kg annually and 25,000kg annually by Knud Jepsen (Denmark)

The high-quality cannabis should not only be consumed in pure form or end up in the pharmacy, but also be used for premium cannabis oils, foods, and even drinks (cannabis beer?) And other applications. The margins with this type of product are significantly higher than the sale of the plant alone.

Not least due to the commitment of Molson Coors' former Inovations Strategist, TGOD is associated with "Beverages" and cannabis beer from Bloomberg.

Everything should succeed with joint ventures, licensing and distribution partners. Even its own 40,000 sq ft Innovation Campus is to be built in Valleyfield, Quebec.

Cheap electricity prices ensure competitive advantage

Strategic partnership with energy management company Eaton Corp. and Hamilton Utility Corp., TGOD is able to reduce its electricity costs from around $ 0.13 per kilowatt hour to $ 5 Canadian cents per kWh. This is one of the lowest electricity costs in the country. In Quebec - where TGOD will produce most of its cannabis - electricity costs are already at a very low $ 0.05 per kWh.

Spin-off as a dividend for shareholders

As Toronto's Toronto Stock Exchange leaves little room for investment in the US, some producers such as Canopy (with Canopy Rivers) and Aurora (with Australis) have decided to spin-off to compete in the growth market of the United States to invest.

TGOD will also go a similar way with "TGOD Acquisition" (the SpinCo) . The only way to get the spin-off shares is to become a shareholder of TGOD on January 31 (record date). Taking into account the value date, you must have the share in your portfolio by January 28, at the latest, to receive 0.15 spin-off warrants per 1 share of TGOD at a later date, which will be used to purchase a spin-off share Price of 0.50 CAD.

The press release can be found here: HERE

Current company presentation Click HERE

We bought the stock on May 9, 2018 at $ 3.65 . On September 20, we sold $ 8.65 at 137% and on November 1,we almost doubled our position at $ 2.80 .

The previous transactions of the CannabisReport.de sample depot:

PURCHASE: Canopy Growth 02.02.2018 to 24.11 CAD

PURCHASE: Emblem Corp 02.02.2018 to 1.54 CAD

PURCHASE: Maricann 02.02.2018 to 2.59 CAD

PURCHASING: Maricann 09.04.2018 to 1.48 CAD

PURCHASE: The Green Organic Dutchman May 9, 2017 at $ 3.65

SALE: Emblem Corp. 14.09.2018 to 1.86 CAD with 20.78% Profit

SALE: Maricann 19.09.2018 to 2.28 CAD with 6.05% profit

SALE: The Green Organic Dutchman 20.09.2018 to 8.65 CAD with 137% profit

SALE: Canopy 16.10.2018 to 76 CAD with 215% profit

PURCHASE: HEXO 25.10.2018 to 5.20 CAD

REPURCHASE: TGOD 01.11.2018 Limit 2.80 CAD

PURCHASE: PLUS Products 29.10.2018 to 3.80 CAD

Disclaimer: The publisher of CannabisReport.de (Daniel Schaad) owns shares and warrants of The Green Organic Dutchman, which he has acquired from private financing rounds (pre-IPO). Therefore, there may be a conflict of interest. However, this text constitutes the author's objective opinion, and was not commissioned by the company or third party discussed, and in no way sponsored or paid. The company discussed is currently -with- no contractual relationship with CannabisReport.de or the publisher. The sources on which the above text is based come directly from the company, from press releases, from own research and from the company presentation.

Subscribe to:

Posts (Atom)