| House Positions for C:OGI from 20210219 to 20210219 |

| House | Bought | $Val | Ave | Sold | $Val | Ave | Net | $Net |

|---|---|---|---|---|---|---|---|---|

| 1 Anonymous | 1,819,299 | 8,228,658 | 4.523 | 1,298,245 | 5,861,328 | 4.515 | 521,054 | -2,367,330 |

| 39 Merrill Lynch | 810,076 | 3,647,021 | 4.502 | 491,400 | 2,214,757 | 4.507 | 318,676 | -1,432,264 |

| 53 Morgan Stanley | 122,299 | 553,261 | 4.524 | 82,943 | 373,514 | 4.503 | 39,356 | -179,747 |

| 9 BMO Nesbitt | 100,484 | 459,941 | 4.577 | 79,278 | 358,966 | 4.528 | 21,206 | -100,975 |

| 80 National Bank | 108,738 | 491,767 | 4.522 | 92,947 | 420,706 | 4.526 | 15,791 | -71,061 |

| 212 Virtu | 60,820 | 273,810 | 4.502 | 47,127 | 213,728 | 4.535 | 13,693 | -60,082 |

| 76 Industrial Alliance | 7,170 | 32,801 | 4.575 | 0 | 7,170 | -32,801 | ||

| 13 Instinet | 4,000 | 18,114 | 4.529 | 133 | 584 | 4.391 | 3,867 | -17,530 |

| 65 Goldman | 4,936 | 21,655 | 4.387 | 1,400 | 6,356 | 4.54 | 3,536 | -15,299 |

| 19 Desjardins | 28,980 | 130,477 | 4.502 | 27,351 | 123,407 | 4.512 | 1,629 | -7,070 |

| 14 ITG | 2,131 | 9,656 | 4.531 | 1,663 | 7,187 | 4.322 | 468 | -2,469 |

| 72 Credit Suisse | 300 | 1,362 | 4.54 | 0 | 300 | -1,362 | ||

| 36 Latimer | 7,001 | 31,509 | 4.501 | 6,816 | 30,735 | 4.509 | 185 | -774 |

| 143 Pershing | 1,000 | 4,550 | 4.55 | 2,900 | 13,264 | 4.574 | -1,900 | 8,714 |

| 57 Interactive | 0 | 2,300 | 10,418 | 4.53 | -2,300 | 10,418 | ||

| 124 Questrade | 17,890 | 80,663 | 4.509 | 22,934 | 102,917 | 4.488 | -5,044 | 22,254 |

| 28 BBS | 1,000 | 4,400 | 4.40 | 26,000 | 117,750 | 4.529 | -25,000 | 113,350 |

| 88 Credential | 12,958 | 58,388 | 4.506 | 44,385 | 202,357 | 4.559 | -31,427 | 143,969 |

| 2 RBC | 117,908 | 528,453 | 4.482 | 155,825 | 703,061 | 4.512 | -37,917 | 174,608 |

| 33 Canaccord | 21,000 | 94,318 | 4.491 | 74,550 | 339,201 | 4.55 | -53,550 | 244,883 |

| 89 Raymond James | 0 | 71,000 | 323,920 | 4.562 | -71,000 | 323,920 | ||

| 85 Scotia | 73,151 | 329,115 | 4.499 | 149,469 | 668,264 | 4.471 | -76,318 | 339,149 |

| 7 TD Sec | 784,234 | 3,526,997 | 4.497 | 960,393 | 4,338,035 | 4.517 | -176,159 | 811,038 |

| 79 CIBC | 1,700,514 | 7,685,817 | 4.52 | 2,166,830 | 9,782,276 | 4.515 | -466,316 | 2,096,459 |

| TOTAL | 5,805,889 | 26,212,733 | 4.515 | 5,805,889 | 26,212,731 | 4.515 | 0 | -2 |

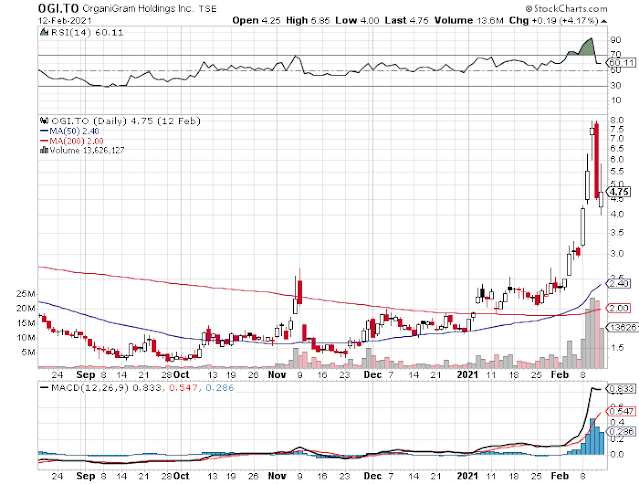

Organigram Holdings Inc. (NASDAQ: OGI) (TSX: OGI), the parent company of Organigram Inc. (together, the "Company" or "Organigram"), a leading licensed producer of cannabis, recently announced its results for the first quarter ended November 30, 2020 ("Q1 Fiscal 2021" or "Q1 2021").

We are pleased with our double-digit sales growth in the Canadian adult-use recreational market this past quarter as it reflects the success of many of our new product launches, particularly in the dried flower value segment," said Greg Engel, CEO. "Now we look forward to our new higher margin Edison dried flower offerings contributing substantially to overall revenue with even more new products to come in the next few quarters. We believe our product portfolio revitalization combined with additional resources to ramp up production and achieve greater economies of scale as well as our relentless focus on increased automation and cost efficiency opportunities position us well to generate further top-line growth and significantly improve gross margins."