Sadly, the bottom line is that the battle in Ukraine is more about energy control between the East and West, than it is about freedom. Ivan Lo The Equedia Letter

While many - especially Canadians - are relaxing in the comfort of their homes, the rest of the world is in a state of instability.

The battle in Ukraine is setting up for a dramatic chain of events between the East and West, while China is working hard to contain a financial breakdown amidst a falling market and economic slowdown.

This week,

Edmund Reilly, 47, a trader at Midtown's Vertical Group, jumped in front of a speeding train.

The deaths/suicides of financial workers continue.

Markets on Thin Ice

The U.S. market has enjoyed a very long and sustained bull market since the crash of 2008.

While fundamentals, such as cost-cutting measures, played a role in the rise of the American market, it was the injection of financial liquidity that proved to be the main culprit.

The mistake is believing that this "printed money" is free; that it somehow just enters our monetary system with a small inflationary price tag.

Unless you're the Fed, there's no such thing as "free money."

A Rapid Rise in Debt

I am about to show you some very interesting charts.

The United States is a world power and a first world nation. It has to spend money to maintain this status by building roads, providing healthcare and public services, and funding wars.

But all of this money has to come from somewhere.

Historically, most of this money came from taxes and government-owned corporations. But as the world power grew - through wars and economic activity - so did its spending habits. Taxes were no longer enough to cover all of the bills. So - like every one else - when you don't have enough money, you borrow it.

When the government spends more than it brings in, it's called deficit spending.

How the Government Borrows Money

The U.S. treasury, the department of the U.S. government that manages all of the Federal finances, borrows money by issuing a bond.

A bond is simply a piece of paper - a promissory note - that says if you give me money now, I will pay you back in X amount years, with interest.

These pieces of paper are then sold through a bond auction where the world's largest banks participate in buying part of this national debt.

The banks then sell these bonds to other investors, such as investment funds and countries like China and Japan.

Take a look at this chart:

In the last five years, America has more than doubled its debt to foreign investors. That means America now owes more money (and interest payments) than ever to foreign countries such as China, Japan, and even Russia.

The Russian Time Bomb?

This week, a whopping $104.5 billion of marketable U.S. Treasury Securities (UST) left the custody of the Fed:

Here's what the change looks like in millions of dollars:

Foreign custody holdings of UST at the Federal Reserve have fallen almost every week over the past few months as emerging market central banks liquidated their UST to support their own currencies.

However, the recent $104.5 billion exit this week was the biggest drop of Treasuries held by the Fed on record.

Does that mean foreigners are dumping U.S. paper? Or Russia is dumping to support the ruble, as sources such as

Zerohedgesuggest?

Not so fast.

Before we jump to conclusions, let's take a look at the facts.

A Better Rationale

When UST are sold, they are sold in US dollars.

Emerging market nations looking to prop up their currency could sell UST in exchange for US dollars, then dump those dollars to buy their own currency. This removes supply of their own currency from the market and increases the supply of the dollar.

Think of it as a share repurchase.

Therefore, when someone sells UTS in large amounts, we should see it affect both the currency and bond market.

A large sale of $104.5 billion worth of UTS would have shocked the market and likely pushed the benchmark 10-year yields higher by at least 30 basis points.

That didn't happen.

Instead, the 10-year yield, which moves inversely to price, dropped to 2.61 per cent on Friday, down sharply from last week's peak of 2.82 per cent.

The currency market was also relatively quiet - too quiet - for such a a massive dump of UST.

Furthermore, if Russia did indeed dump more than half of their UST holdings (which they claim to have $200 billion worth), it would likely not have held the proceeds in US dollar, but rather used it to prop up its ruble.

But for the week ending March 12, Russia only bought 154.97 billion rubles - or roughly US$4.3 billion.

If Russia was the culprit for the dump, where's the other $100 billion?

What do you think happened?

Preparing for Conflict

Tensions between the East and West have grown stronger than they have ever been since the Cold War.

On Monday, Obama threatened to impose penalties on Russia unless it withdraws its military forces from Crimea. The next day, Russia reportedly called troops on military exercises back to their bases.

Then it was announced that for the week ended March 12, $104.5 billion worth of UST have been moved away from Federal Reserve custody.

Since little reaction was seen in the currency and bond market, a transfer of holdings was likely the culprit - and not a sale.

U.S. recently threatened economic sanctions against Russia. In preparation, Russia could have removed its UST holdings away from American custody; thus preventing Obama from freezing Russian dollar assets in America.

Back in 1957, after the Soviet Union invaded Hungary, Moscow-based Narodny Bank transferred dollars from the U.S. and deposited them in its branch in London, leading to global credit and dollars held outside of the US.

On Friday, after the report of the massive UST dump/transfer, Russia warned that it was prepared to intervene in eastern Ukraine - ignoring the threats of economic sanctions.

In short, when America threatened economic sanctions against Russia, Russia backed off. Then, after a massive transfer of UST, Russia comes back and threatens intervention in Crimea.

The Real Reason for War in Ukraine

The tensions between Russia and America are getting worse, as I mentioned they would in my strings of letters

regarding Syria.

While America remains a world power, its ability to control the world is diminishing - especially in Europe. As Obama continues to threaten Russia with economic sanctions, Russia continues to flex its political strength, with energy as its muscle.

America is the largest exporter of currency, while Russia is the largest exporter of natural gas on the planet.

In order for Western economic sanctions to work, the EU will have to be on board.

Russia supplies about 30 percent of Europe's natural gas, which means Russia could slowly cut off supplies to European nations if economic sanctions are imposed. On the other hand, given that 70% of Russian gas imports go to Europe, cutting supply to Europe will also hurt Gazprom.

Sadly, the bottom line is that the battle in Ukraine is more about energy control between the East and West, than it is about freedom.

While Syria has slipped down the agenda of Western media, the nation is still very much in conflict without resolution and the battle for energy control in both Syria and Ukraine is becoming more dangerous.

If Russia did indeed transfer such a large amount of its UST holdings away from the Fed, then it is likely preparing to defy America.

That means we should prepare for conflict escalation.

Prepare for More

According to a senior adviser to the Kremlin, via

Ria Novosti:

An adviser to Russian President Vladimir Putin said

Tuesday that authorities would issue general advice to dump US government bonds in the event of Russian companies and individuals being targeted by sanctions

over events in Ukraine.

Sergei Glazyev said the United States would be the first to suffer in the event of any sanctions regime.

"The Americans are threatening Russia with sanctions and pulling the EU into a trade and economic war with Russia," Glazyev said. "Most of the sanctions against Russia will bring harm to the United States itself, because as far as trade relations with the United States go, we don't depend on them in any way."

Glazyev noted that Russia is a creditor to the United States.

"We hold a decent amount of treasury bonds - more than $200 billion - and if the United States dares to freeze accounts of Russian businesses and citizens, we can no longer view America as a reliable partner," he said. "We will encourage everybody to dump US Treasury bonds, get rid of dollars as an unreliable currency and leave the US market."

These comments sparked the possible outbreak of war, sending the ruble down last week.

While other senior Russian officials have slammed Glazyev's comments, the thought of Russia persuading others to dump the US Dollar in trade is closer to reality than most would think (

see The Brink of War).

China, the largest foreign holder of U.S. debt, has already been dumping UST and has increasingly made agreements to settle foreign contracts in currencies other than the Dollar.

More importantly, what will become of your money?

The Bright Side

Uncertainties around the World are leading to a renewed interest in safe haven investing. Gold is now nearing $1400 - a number that could revive the profitability of gold miners and trigger a renewed bull market in gold mining stocks.

As I mentioned

early January, I expect gold stocks to do very well - better than gold itself.

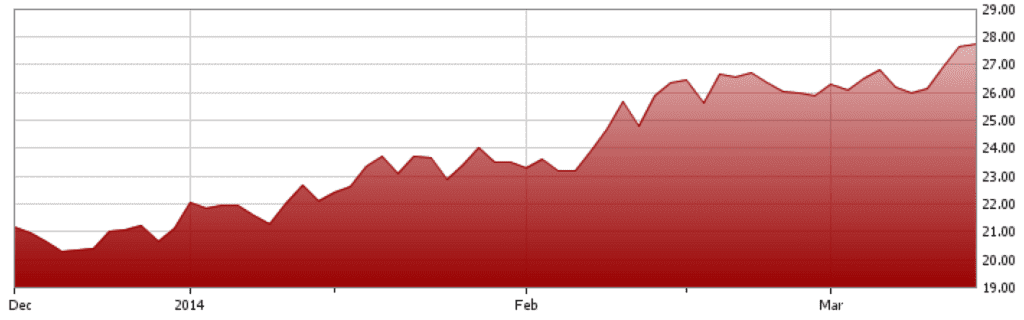

Here is a 3-month chart of the Market Vectors Gold Miners ETF, the GDX, up over 25% YTD:

|

| YTD Chart, GDX |

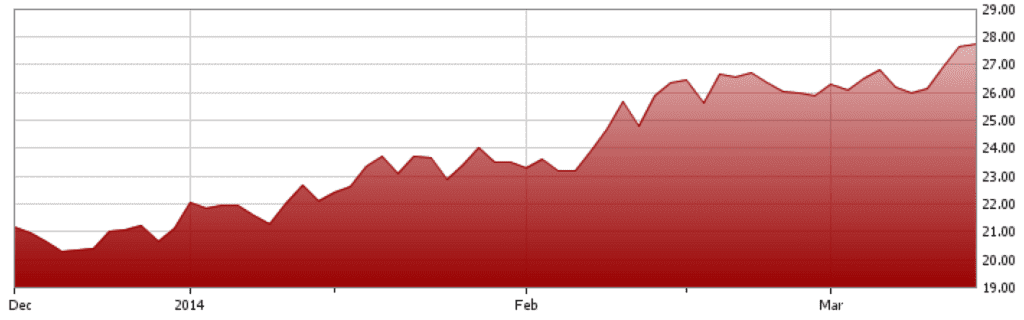

Here is a chart of the GDXJ, the junior gold stocks ETF - which I expected to outperform the GDX - up over 36% YTD:

|

| YTD Chart, GDXJ |

Gold is now up 6 weeks in a row - the longest win streak since the run into the Aug 2011 highs.

You may be tired of hearing about gold, but you won't be if it starts to climb higher.

And higher is where I expect it to go.